I work in financial planning because it’s interesting and actually important. It is also an industry that doesn’t get talked about all that often, and it is not the booth at the career fair that students run towards first.

I’m not going to lie, it’s been quite a roller-coaster of emotions since I’ve gotten there. Though this isn’t intended to be a diary entry of my feelings, I want to address a few of them and where they stem from.

Happiness:

- Happy that I found myself working in financial planning – or perhaps that the field found me

- Happy to have the co-workers that I do

Frustration:

- Frustrated with the lack of diversity and clarity of growth path

- Frustrated with the gender and salary divides

Eagerness:

- Eager to make an impact somehow

- Eager to learn more about the industry, the organization and the motives of each one

Before I get to elaborating, it’s important to know a few facts and statistics for context:

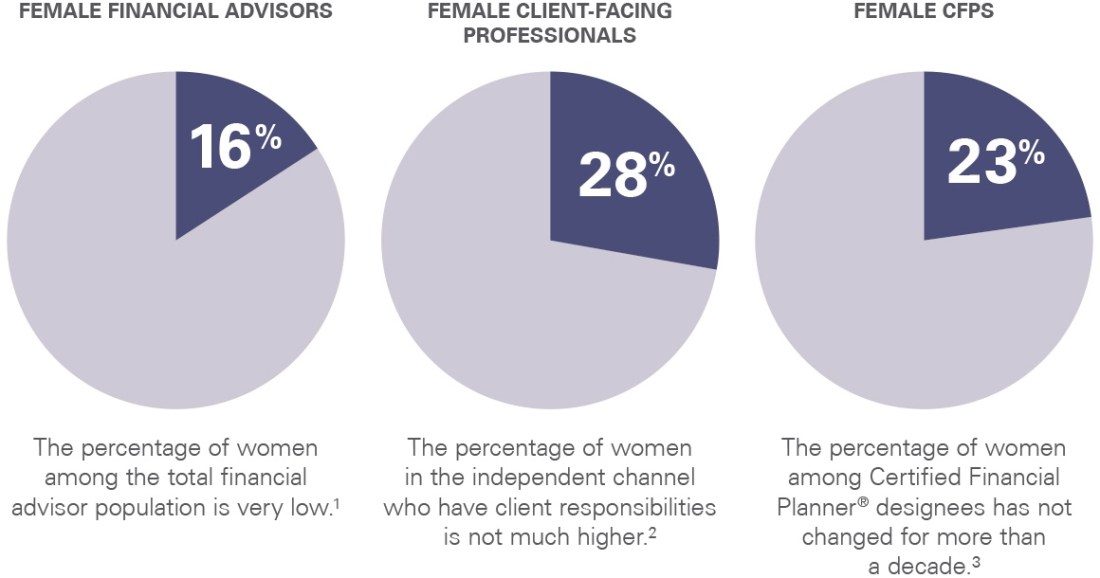

Women remain largely underrepresented in the financial advice industry, and the gender divide has hardly shrunk even in recent years.

Source: Certified Financial Planner Board of Standards, “CFP Professional Demographics,” as of 9/2017

According to a report released by the Institute of Women’s Policy Research, women’s median earnings are smaller than that of men’s in nearly all occupations. Researchers from the Bureau of Labor Statistics analyzed 120 occupations in their study. They found that the occupations with the lowest pay had the smallest wage gaps and vice versa for those of the highest paid occupations. The widest gender pay gap of all 120 occupations was found to be among female financial advisors.

Going off of my imperfect photographic memory, as it stands, the office I work in has about:

- 11 full-time male financial advisors (not including the two recently announced new hires, also both male)

- Zero full-time female financial advisors

- 5 full-time male support staff (each working in different capacities)

- 23 full-time female support staff (each working in different capacities)

I welcome all and any thoughts, though I don’t think it requires much thought to recognize what’s wrong with those distributions. Ethnic diversity is also lagging; I can’t speak for everyone’s background, though the population of the office is predominantly white by a large margin.

For over a full year, I walked to make copies in the printer room, where I glanced at the displayed board of all the financial advisors in our office. There has yet to be a single woman making an appearance on that board, for over a full year. I remember as a little kid, I would watch WNBA games and I could just picture myself playing on that basketball court one day. Well, here I was, a pretty big kid now, and I could just see myself on that board in the printer room. Trust me, I’ve played ball with the boys growing up, and joining the “boys club” of financial advisors wasn’t going to intimidate me either. In fact, I was eager to dent the diversity of it, and for what it’s worth, I’d be thrilled to wear my bowtie to fit in with everyone else’s look.

Reality check: the Future is Female.

There’s only so much I could do and say right now to empower others to recognize the evident need for action. However, I could encourage everyone – not just those in the financial planning industry – to use the magnificent power of their individual voices to speak up if something (read: anything) feels off in your workplace. For example, in a recent conversation, I had to address why it was okay for me to discuss my salary with my colleagues. No one is walking around taking surveys of everyone’s salaries, but is important for employers to know that pay secrecy and even merely discouraging salary discussions is illegal. I, as a queer woman working in a male-dominated industry, have every right to know how my salary stacks up against my counterparts, especially when our duties greatly mirror one another’s and the biggest factor differentiating our salaries has to do with our separate advisors.

It’s really cool to have a focus and it’s really cool to have that focus become your forte. I have no idea where my future is going to take me, so for the time-being, the financial planning industry is my focus. There’s always the option to steady cruise through a career; you can hit the bare minimums and you can learn the basics to get by. Or you can challenge yourself beyond that.

You can learn the ins and outs of your company and the industry until you know it as well as the back of your hand. Only you get to decide the extent of your involvement. You can become an expert by learning the roles and rules and policies and regulations of not just your position. If you have people working for you, you can listen to learn what matters to them and what motivates them. If you work for someone, you can learn what you can do to maximize your impact and soar beyond the goals you are working towards. You can read relevant news and see what the competitors are doing. The resources are at our fingertips; most of us can pull up a Google search box within ten seconds. What isn’t at our fingertips? The inner drive to go beyond those bare minimum marks.

When’s the last time someone in your office read your company’s Glassdoor reviews? When’s the last time someone in your office took what employees have written in those reviews to heart? When’s the last time an employer checked where today’s market values lie? When’s the last time you as an employee, checked your own worth? When’s the last time someone took the time to address and implement necessary changes?

Consider those questions rhetorical if you choose. I sure as heck am not. I don’t want those questions to remain rhetorical because my curiosity has recently overpowered my prolonged silence.

I don’t know what change in the financial planning industry looks like, I just know that it’s needed. I don’t yet know who to talk to or where to get involved to address the really important matters either. It’s funny, it’s sad, it’s unfortunate that I have yet to find a person in the office that I can comfortably confide in that could point me in some direction to have my voice heard. I’m very vocal, pretty personable, arguably amicable among my colleagues. Don’t get me wrong, my coworkers are well-aware of what I care deeply about; they have consistently been unfailing kind, loyal, respectful, and supportive of my voices and choices. I promise you, finding a person to confide in has nothing to do with my colleagues; it has to do with the fact that as it stands, there are zero female financial advisors walking around that office. Please note: that statement does not speak for the industry or the organization at large, both of which have seen positive strides forward. Regardless, even with those positive strides, it is not yet enough. I intend to be involved until more profound changes regarding inclusivity and diversity are implemented. Enough is enough: the financial advising industry is in desperate need of improving its diversity and enforcing pay equity. We need to rid the discomfort I feel just thinking about walking into work wearing a bowtie.

Sources:

https://global.spdrs.com/blog/post/2018/jan/more-than-a-diversity-target-women-in-advice.html